avalara tax codes by state

General tax code for the retail sale of firearms PF030746 Gun locks trigger locks and cables does not include gun cabinets and cases PF030900 Ammunition General tax code for the. Sales tax nexus is a term you probably hadnt heard before it became relevant to your business.

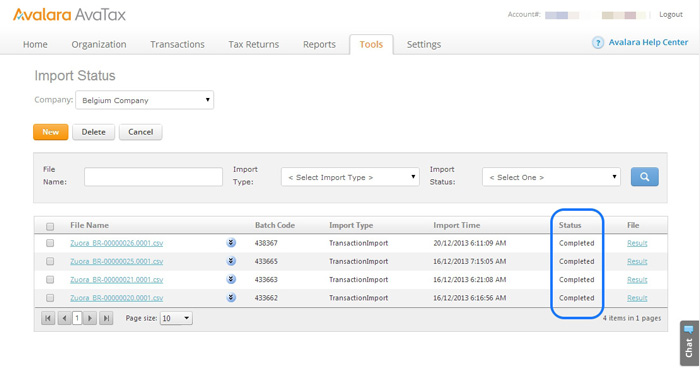

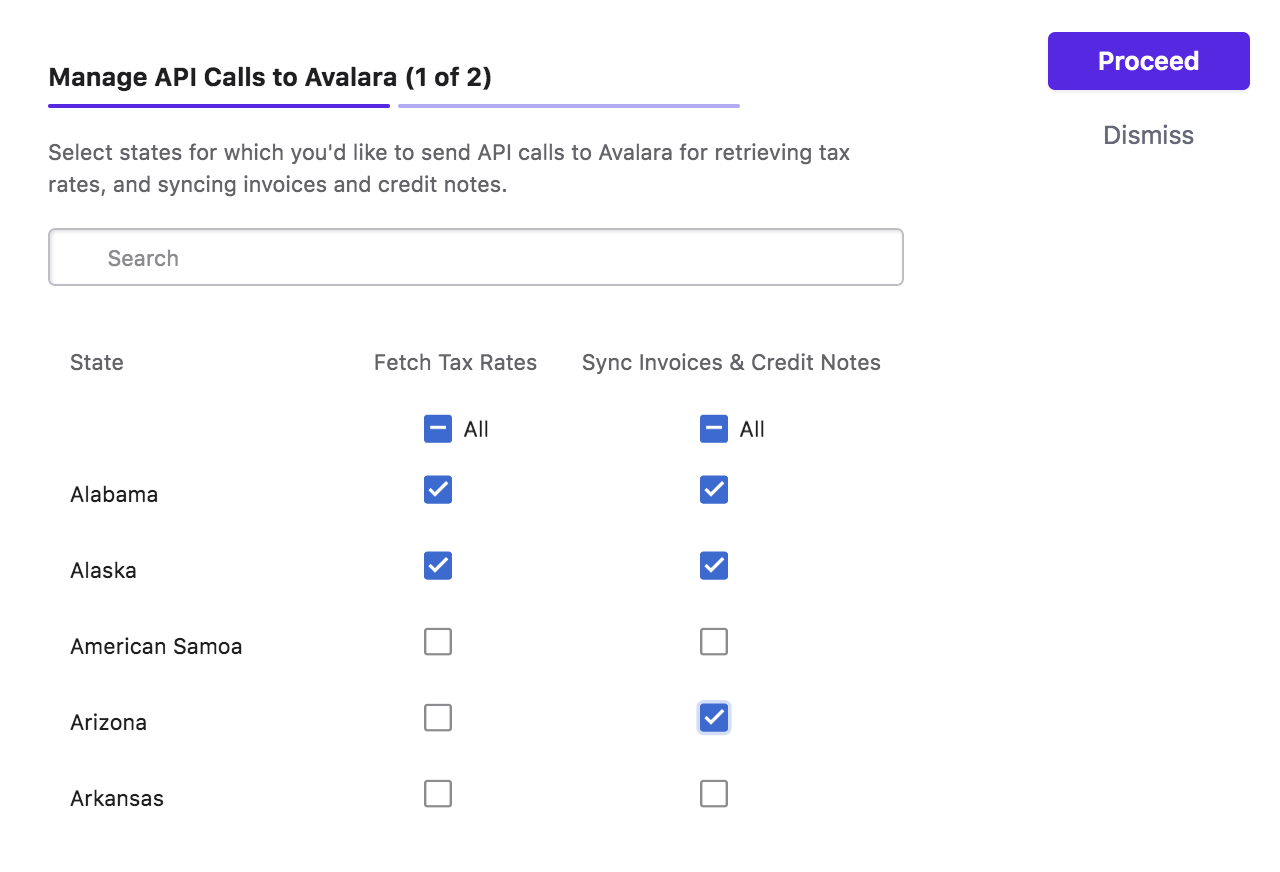

Avalara Taxes In Api Calls And Bill Runs Zuora

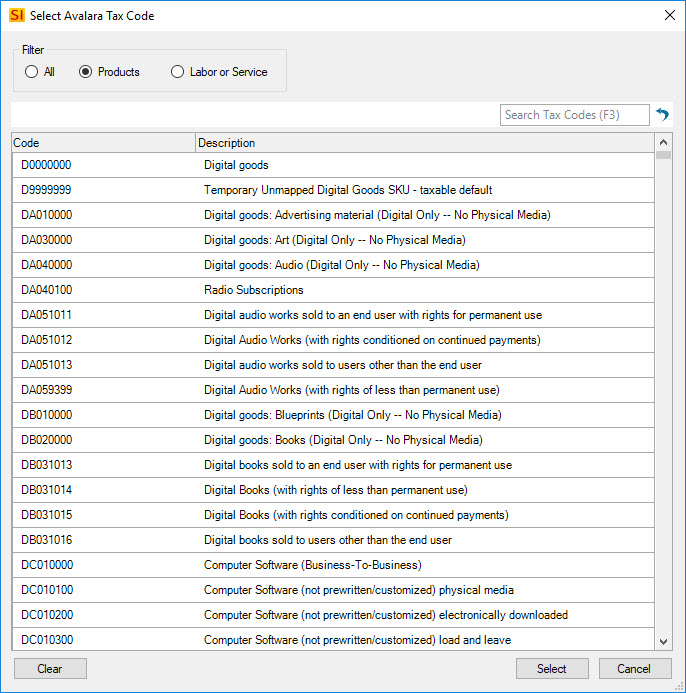

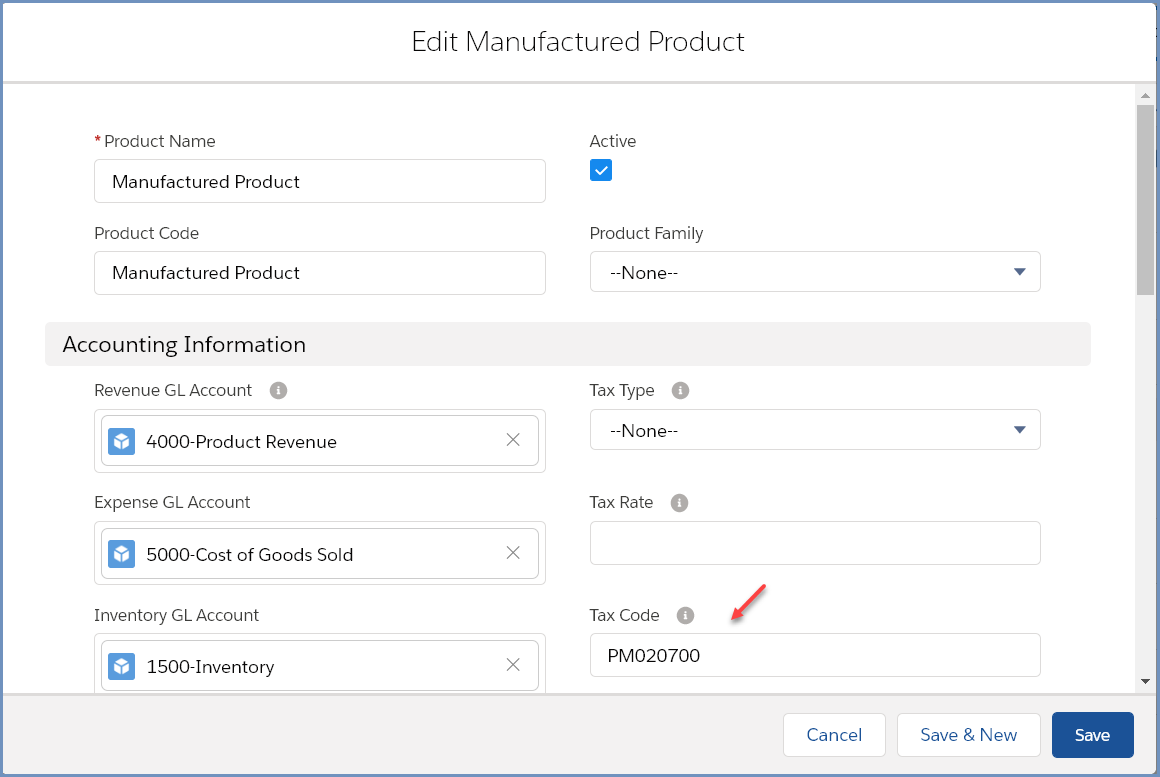

However if your product falls in a different category you can enter.

. Select the states in which you do business. Learn how Avalara can help your business with sales tax compliance today. Find the Avalara Tax Codes also called a goods and services type for what you sell.

Some products require special tax treatment. Select Settings What You Sell. 250000 in sales only.

P0000000 and U0000000 are generic codes that are used when you have items that arent mapped to an Avalara tax code. 10 or more sales totaling 100000 or 100 transactions prior to October 1 2019. AvaTax for Communications supports tax calculation for a number of countries states territories and provinces.

Learn how Avalara can help your business with sales tax compliance today. Like so many other aspects of daily life sales and use tax compliance has been affected by the pandemic. There are also questions about next-generation.

Select Add an Item. Find the average local tax rate in your area down to the ZIP code. With all the price volatility and geopolitical risk coming out of the war in Ukraine energy companies have a lot to keep track of.

Streamlined Sales Tax SST is a state-run program designed to make sales tax compliance easier and more affordable by offsetting the cost of using a tax. When to map items. This change was effective in Avalara products on April 1 2018.

If youre still a bit fuzzy on what it is or what it means for you youre. A new retail delivery fee is taking effect in Colorado on July 1 2022. 149 rows AvaTax for.

Ad Solutions to help your business manage the sales tax compliance journey. AvaTax uses these values to identify tax jurisdictions and apply the correct tax. P0000000 and U0000000 are generic codes that are used when you have items that arent mapped to an Avalara tax code.

This makes them the wrong tool to use for determining sales tax rates. 25000 in physical products taxed at the general 625 rate. Industrial production or manufacturers.

Follow the directions below to map codes in AvaTax. These tax codes are taxed at the full rate. You can use this search page to find the Avalara codes that determine the taxability of the goods and.

Every tax jurisdiction in AvaTax is assigned a unique jurisdiction ID code and name. Address and get the sales tax rate for the exact location with the Avalara real-time sales tax calculator. 150 rows Supported regions.

By basing sales tax. The general tax rate is 625 but food is taxed at a reduced rate of 10. Tax codes PM020704 and.

Ad Solutions to help your business manage the sales tax compliance journey. We publish tables based on our latest. In fact the top three risks to growth in 2022 are 1 the.

50 rows Download a free sales tax rates table by ZIP code for any US state. Sales tax nexus 101. A state-by-state analysis of charging sales tax on services.

When state legislatures in the United States implemented the first sales tax laws to boost revenues in the 1930s the American. What is Streamlined Sales Tax. Theyre useful in states like.

If you sell items such as clothing food software medical supplies software subscriptions and freight map. Retailers will have to collect the 027 fee every time they deliver taxable goods to a Colorado address. New tax obligations resulting from increased eCommerce.

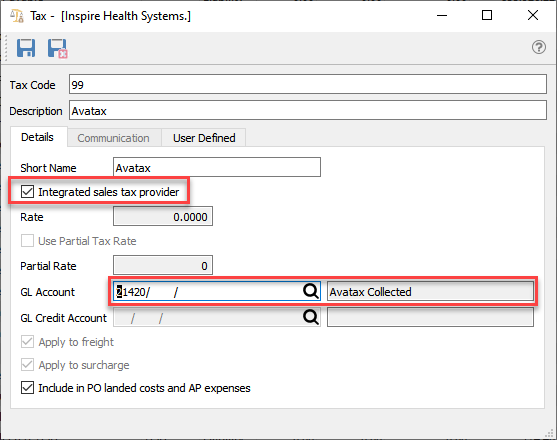

The Default Product Tax Code you entered under Setup Taxes will be automatically populated. To ensure accurate tax. Enter the item code that you use for freight in your business.

Our Breaking into New Markets session led by Avalaras Senior Director Sacha Wilson will cover topics such as. 75000 in food taxed.

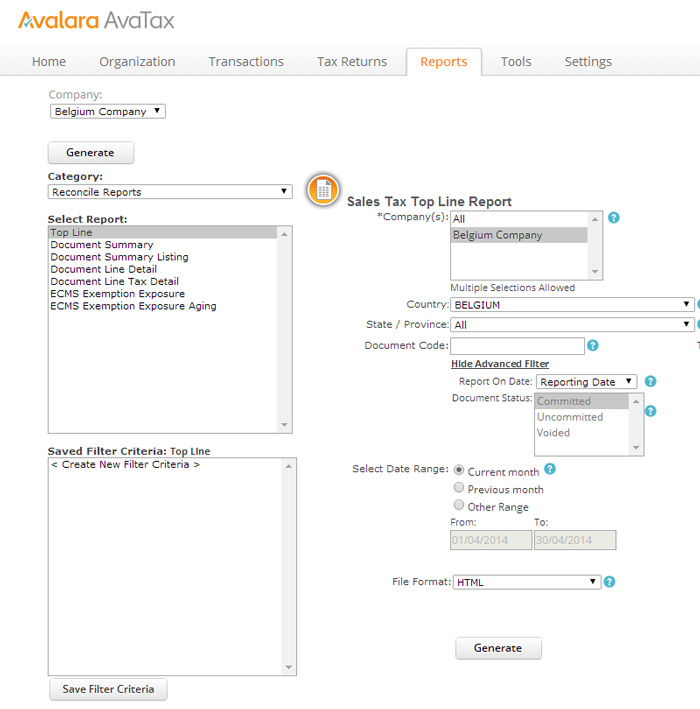

Understanding The Avatax For Communications Tax Engine Avalara Help Center

Avalara Tax Integration D Tools

Avalara Sales Tax Spire User Manual 3 7

Sales Tax Calculation Software Avalara

Wbavatax Avalara Avatax Tax Calcuation Integration Whmcs Marketplace

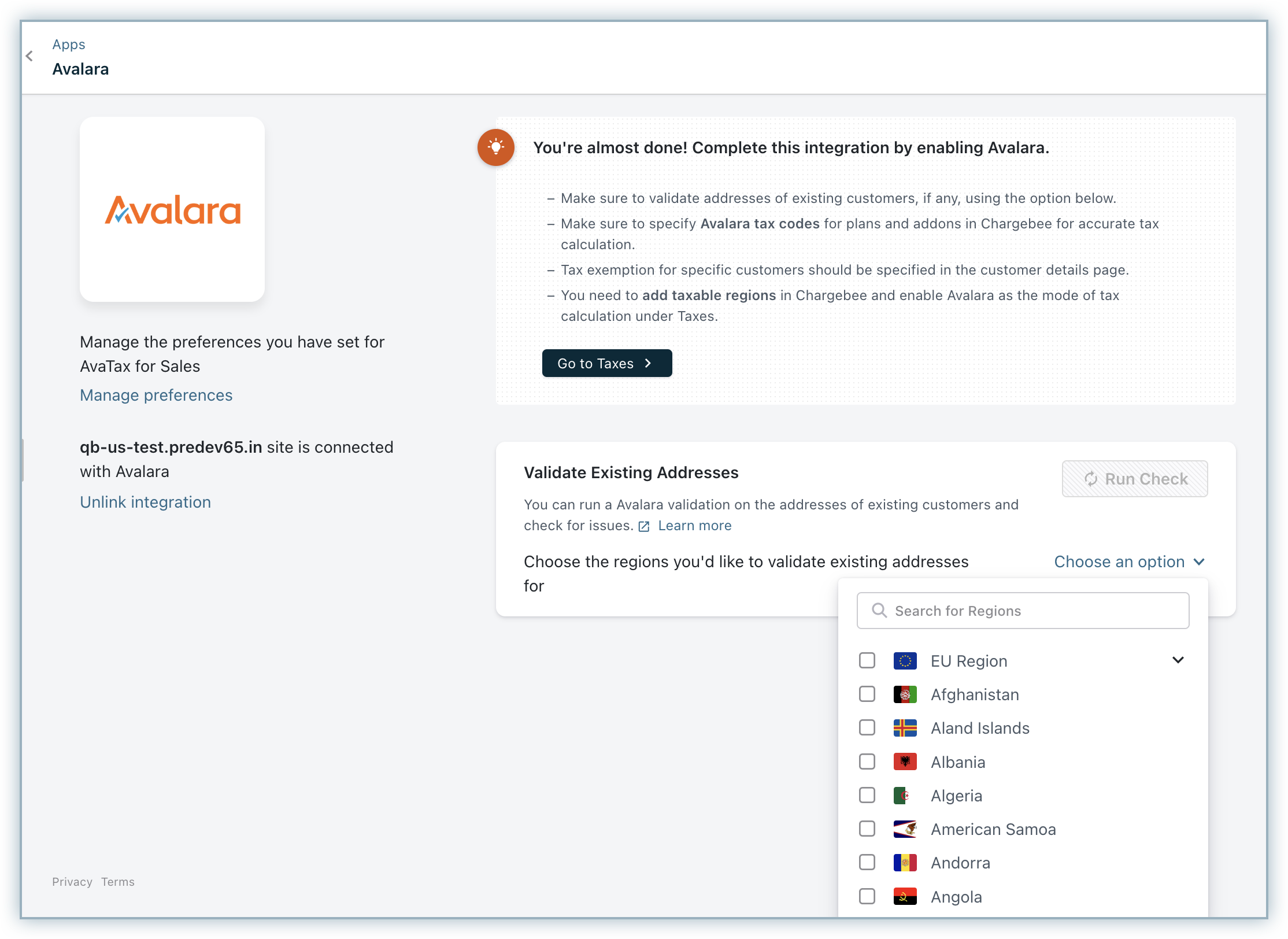

Avatax For Sales Chargebee Docs

Generate Tax Reports In Avalara Zuora

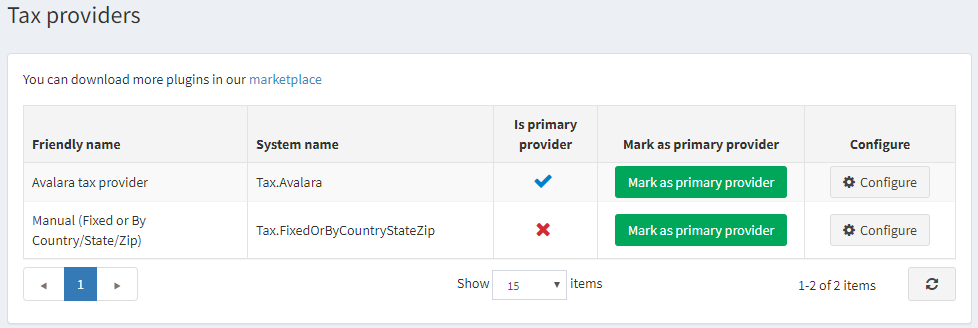

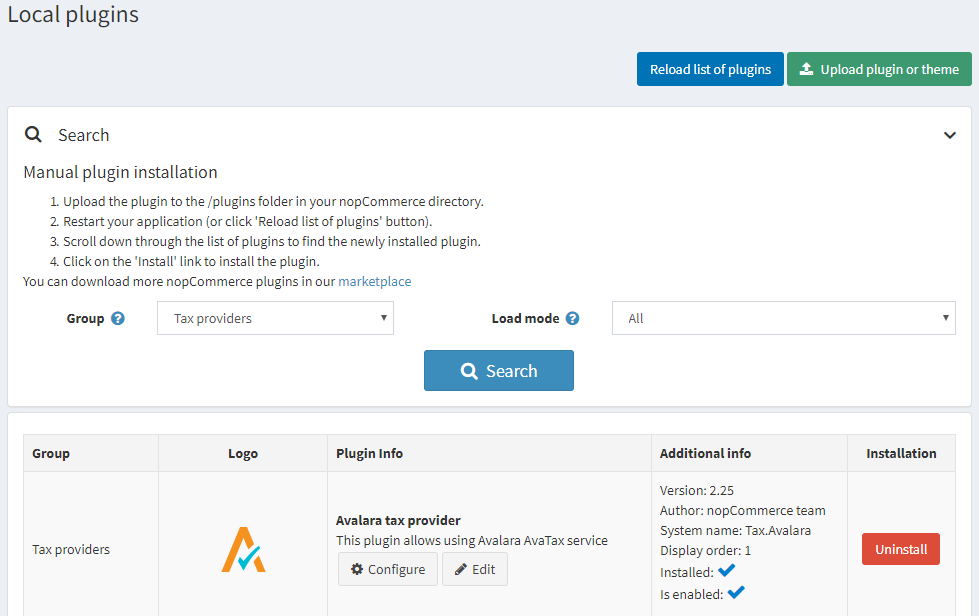

Set Up Avalara Avatax Integration Accounting Seed Knowledge Base

Understand Sales Tax Holidays In Avatax Avalara Help Center

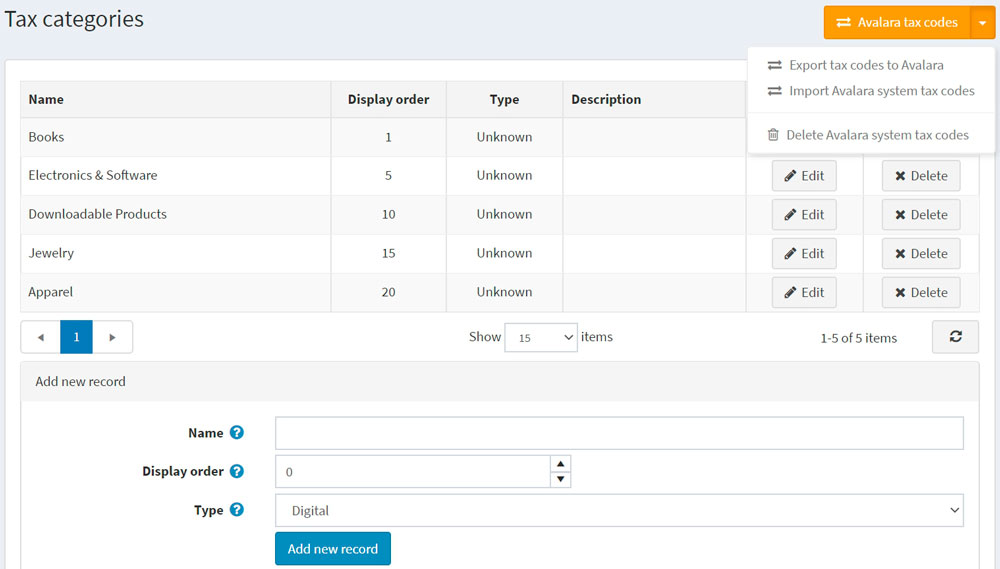

Map The Items You Sell To Avalara Tax Codes Avalara Help Center

Avalara Avatax For Adobe Commerce Adobe Exchange

Avalara Review Sales Tax Simplified Business 2 Community

Avatax For Sales Chargebee Docs

Enablement Steps For Advanced Taxation Nimble Ams Help

Sales Tax Calculation Software Avalara

Up To Date 2021 North Carolina Sales Tax Rates Use Our Sales Tax Calculator Or Download A Free North Carolina Sales Tax R Tax Guide Online Taxes Filing Taxes